Manage your account online

H&R Online is our digital service, helping you manage your savings account online.

H&R Online >

Add to your savings from your pay

A Workplace Savings initiative designed to make saving as hassle-free as possible to help you grow your savings pot through your employer.

Find out more >

Worried about money?

MoneyHelper is a government-backed service that offers free and helpful advice if you are worried about money.

MoneyHelper >

Financial Education

We aim to help our members achieve and maintain financial security. Explore how we’re helping in local education and supporting UK Savings Week.

Learn more >

Visit your local branch

Find your local branch or agency, opening hours, address, and contact information.

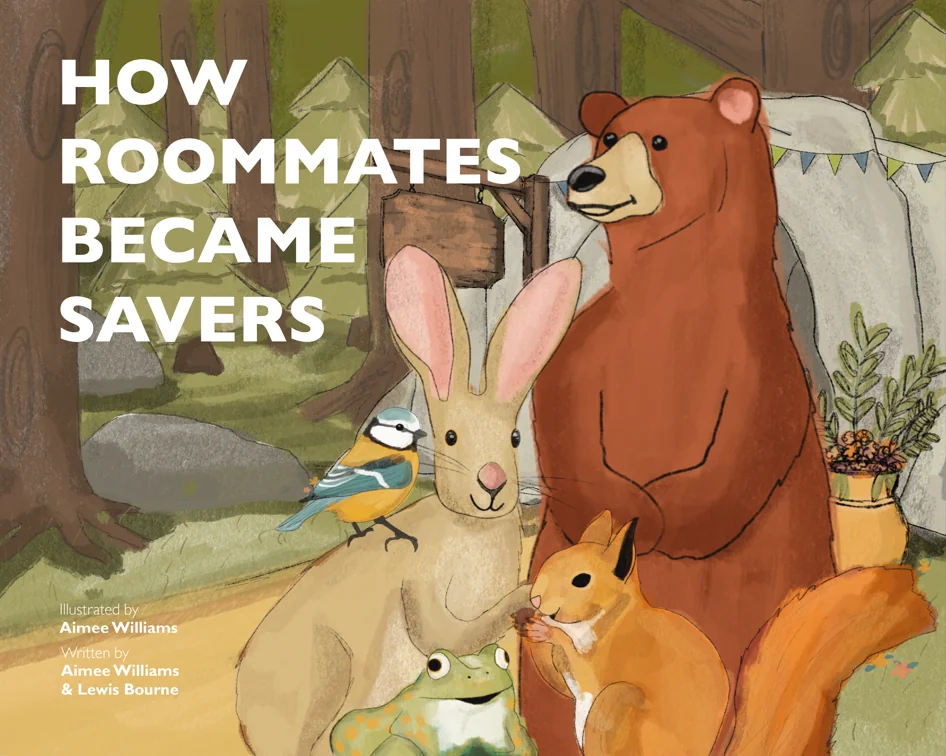

Branches and agencies >Receive a book for young readers

We have launched a fun and educational book educating young readers on how Building Societies came to be. The book introduces them to the world of saving from an early age through the eyes of a gang of woodland animals.

This book is designed to teach young readers how saving little and often can help them achieve financial goals of their own. Children’s savings accounts are the perfect tool to teach your child the value of saving and financial responsibility.

We’re giving this book free of charge for those opening a new Young Saver savings account or make a deposit to an existing Hinckley & Rugby children’s savings account. Find out more by clicking below and receive your free copy!

Saving with Hinckley & Rugby

We aim to make saving easy and accessible for all our members. With branches in Leicestershire and Warwickshire our priority is to build and maintain long-term relationships with our savings customers. That’s why we’re committed to maintaining our presence on your local high street.

Our friendly and helpful team will assist you every step of your savings journey, providing you with peace of mind knowing that your savings are secure with us.

Not sure what you need?

Let us help

Explore our website to find what you need, or click below to get in touch with a member of our team.