Tailored Term Mortgages

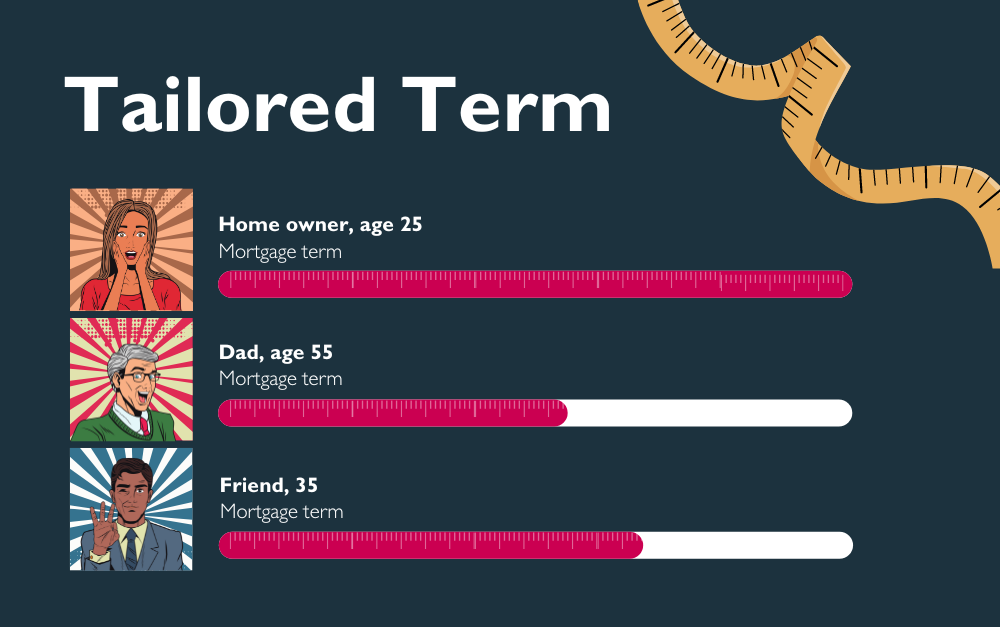

Tailored Term allows multiple applicants to share the cost of the mortgage over separate time frames. It is a ‘made-to-measure’ add-on which can be applied to any mortgage from our product range, at no additional cost.

Most popular on our Flex Together – enhanced Joint Borrower Sole Proprietor range, the Tailored Term comes in handy where there are two or more applicants that have a significant age gap. We will calculate what the youngest applicant can afford over the maximum term, leaving the older applicant to top up affordability over a shorter term.

Example:

- A first-time buyer requested £440,000 to purchase her first home

- Dad wanted to help with the financial side, so agreed to join the mortgage on a joint borrower sole proprietor basis

- Daughter, aged 25, could afford £226,947 over 40 years in our affordability assessment

- Dad, aged 58, could afford the remaining £213,053 over a 17-year term using his earned income in our affordability assessment

- Monthly payment without Tailored Term – £2,858.24

- Monthly payment with Tailored Term – £2,259.08

To run through the affordability and to see if Tailored Term will work for your clients contact our team on the details below.

Get in touch

Call us on 01455 874 084 to speak with a member of our team. Our phone lines are open Monday – Friday 9am – 5pm, we are closed on weekends and bank holidays. If you require a case update, please call us 01455 894 736 Monday – Friday 9am – 5pm. You can also Live Chat with us, send us an email or contact a member of our team.

Not sure what you need?

Let us help

Explore our website to find what you need or click below, and get in touch with a member of our team.